The people around the world are using their smartphones to pay their bills. Shopping sites like Amazon is providing them the “amazon pay balance” option in which they can add money and pay for products using that balance. However, lesser people know that they cannot just add amount to the wallet, but can also transfer the balance to their bank account. There is an app Snapay that makes it possible. However, it charges approx 3% to transfer to the bank account.

Why you need a smartphone money transferring app?

You went for a dinner but forgot to carry wallet- you cannot run to the ATM because your cards are in the wallet. Here, you have your smartphone in the pocket as no one forgets his/her mobile. You have two options- either you can make call to any of your friends and wait for him/her to arrive at the location or you can simply use money transferring app and pay your bill.

What benefits will you get if you use Snapay?

Snapay application follows a POS device through a smartphone providing traders and peers to receive the payments immediately via different mobile devices. There is no particular hardware needed to complete the task. You just require an internet link to accept and make payments and a camera. Snapay reduces the need for a physical POS or CC (credit card) as it generates single QR codes that include dollar amount to be charged and payment details of the receiver. This method is encrypted and when a buyer or peer wants to make payment, he/she just snap the QR code image available on the merchant’s mobile and that’s it- payment is done.

Snapay provides individuals with a VISA/MasterCard or e-wallet to pay by a bank account. You don’t need personal credit cards or bank account to use snapay app. The app also expels payment related issues by making an open network to pay and accept money through mobile devices. This determines three key problems related to payments-

- Excessive dependency on hardware to accept payments

- Fragmented mobile payment industry

- Offering mobile-first payment solution

Advantages of using snapay app-

- You can use snapay to transfer your Amazon pay balance to bank account on the same day

- All the cashback on Amazon pay can be easily converted and sent to your bank account

- You just need your adhar card image to create a snapay account

Such set of benefits comes with a few negatives-

- You can only do a single transaction to transfer money to bank account on the same day with approx 3% charge.

- Fund transferring won’t be allowed on bank holidays.

- It is not an instant process

- Potential for chargebacks. In the event of unauthorized transactions, a chargeback might be initiated, leading to complications and potential delays in receiving funds.

- Potential hacker target due to excessive popularity

Securitymatters

Mobile wallets are secure only if your mobile is protected. Even though there are fewer cases of mobile wallet attacks, the number may rise with the popularity. Moreover, someone can just take or steal your phone.

If someone steals your phone and manages to get PIN, he/she can transfer money whenever require. To prevent such scenarios, you can use extra security features of a mobile wallet like requiring a password authentication for each transaction.

You can enable two-step verification in your Amazon account to make it extra secure. Here are the steps to enable this security feature –

- Go to Account and select Login & Security Settings

- Select Edit in the Advanced Security Settings

- Get Started to setup your two-step verification

- Fill the details required and finally enter and verify code you shall receive on your phone number (used in the details)

Snapay is India’s premier credit card-based mobile payment app extending payments from credit cards to any bank account. It has a secure payment option. Secure Pay is like the Escrow Payments, through which Snapay holds and manages payment of two parties involved in the transaction. This way, you can protect your Whatsapp/Facebook Shopping using Snapay’s secure payment technology.

With 82% of U.S. adults own at least one credit card, the demand for flexible and seamless credit card transactions continues to grow globally.

How much safe Snapay is?

Snapay is effectively protected. Every business transaction detail is confirmed under SSL and PCI-DSS technology in Snapay.

What happen if the transaction failed?

If your transaction declined due to any problems, the amount will be credited to your bank account.

What type of payments can be done via Snapay?

You can process any kind of payment like bank account, UPI, NEFT, Credit/Debit card via Snapay.

Is it possible to cancel payment?

Yes, it is likely to cancel your payments within 12 hours of the transaction made. After that time, your amount will be credited to a particular account. You can get in touch with Snapay care for any cancellation.

How to use snapay app?

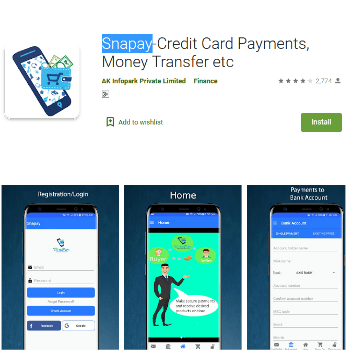

Here Android Application Development Services bring the steps that will help you understand to use Snapay app on your mobile device to transfer Amazon pay balance to your bank account. Let’s learn and see how it works.

-

Downloads APK From Playstore Of SnaPay

![snapay app]()

-

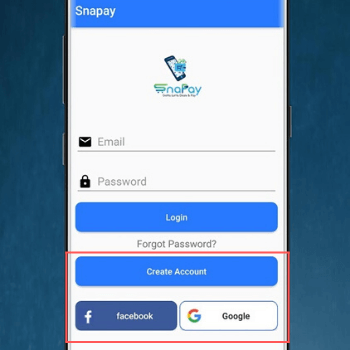

Create a New Account with Google or Facebook

![create account]()

-

Enter Phone Number & Verify OTP

![generate otp]()

-

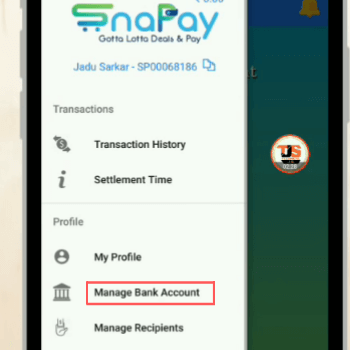

Finally, Open App & Click On Left Below Corner & Updated Your Bank Account (Paytm & Other Payment Bank Also Supported)

![manage account]()

- Now Click Right Payment Request Options & Updated account details & Enter Payment Request Amount

-

Continue & Select Payment Way As Wallet

![choose wallet]()

-

Then Select Amazon Pay Balance

![amazon pay balance]()

-

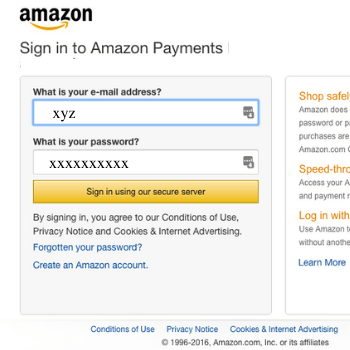

Login Your Amazon Account Finally Make Payment ₹100 + 2.99% Charge

![sign in amazon payment account]()

-

After Making the Transaction You will Get the Equal Balance in your Bank Account in Same Day

![payment successful]()